The North Carolina Clean Energy Technology Center (NCCETC) at NC State University has released a new resource for both commercial and public sector customers interested in purchasing an electric vehicle or installing a charging station.

The North Carolina Clean Energy Technology Center (NCCETC) at NC State University has released a new resource for both commercial and public sector customers interested in purchasing an electric vehicle or installing a charging station.

The new guidance document – Electric Vehicles & Electric Vehicle Supply Equipment Incentives in North Carolina – will help customers navigate the variety of direct financial incentives for electric vehicles (EVs) and supporting EV infrastructure and planning offered throughout North Carolina. Incentives are available through federal, state, regional and electric utility funded programs.

Heather Brutz, Director of the Clean Transportation program at NCCETC, is seeing a frenzy to electrify in both the commercial and public sectors of the transportation industry. “We are seeing light-duty electric vehicle ownership skyrocket and medium duty and heavy duty vehicles are following close behind,” Brutz said.

With a burgeoning EV market, transportation electrification has gained significant momentum and is leading the way towards an emissions-free future. North Carolina, along with the rest of the United States, is poised to make substantial advancements in the development and adoption of clean transportation technologies in order to affirm the state’s commitment to reducing statewide greenhouse gas (GHG) emissions and drive the adoption of zero emission vehicles (ZEVs).

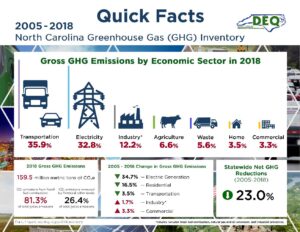

The North Carolina Department of Transportation (NCDOT) released a statewide GHG inventory in 2018 which found that North Carolina’s transportation sector contributed almost 36% of the state’s total greenhouse gas emissions. NCDOT states reducing GHG emissions in the transportation sector is a critical component of the state’s strategy, and the department has been working with stakeholders to develop plans and strategies to reduce transportation emissions.

The North Carolina Department of Transportation (NCDOT) released a statewide GHG inventory in 2018 which found that North Carolina’s transportation sector contributed almost 36% of the state’s total greenhouse gas emissions. NCDOT states reducing GHG emissions in the transportation sector is a critical component of the state’s strategy, and the department has been working with stakeholders to develop plans and strategies to reduce transportation emissions.

On Oct. 29, 2018, Gov. Roy Cooper signed into law Executive Order No. 80 (EO 80), “North Carolina’s Commitment to Address Climate Change and Transition to a Clean Energy Economy.” EO 80 calls to reduce greenhouse gas emission to 40 percent below 2005 levels by 2025.

In January 2022, Gov. Cooper signed Executive Order 246 (EO 246), “North Carolina’s Transformation to a Clean, Equitable Economy.” EO 246 builds upon EO 80 and calls for a 50 percent reduction in economy-wide greenhouse gas emissions by 2030. It also sets a transportation-specific goal to increase the total number of registered zero-emission vehicles to at least 1,250,000 by 2030 and increase the sale of zero-emission vehicles so that 50 percent of all in-state vehicle sales are zero-emission by 2030.

The Inflation Reduction Act (IRA) of 2022 is the most significant action Congress has taken on clean energy and climate change in the nation’s history. The bill includes $370 billion in investments committed to building a new clean energy economy through a combination of grants, loans, rebates, incentives and other investments.

The IRA makes several changes to the tax credit provided for qualified plug-in electric drive motor vehicles, including adding fuel cell vehicles to the tax credit. The IRA also added a new credit for previously owned clean vehicles.

The IRA makes several changes to the tax credit provided for qualified plug-in electric drive motor vehicles, including adding fuel cell vehicles to the tax credit. The IRA also added a new credit for previously owned clean vehicles.

Legal and regulatory barriers can affect the pace of EV technology adoption and deployment, but clear policy goals can both provide market certainty and help accelerate deployment. Incentive programs are driving demand higher across the nation, resulting in an increase in EV adoption as electric and hybrid vehicles move past early adoption and into mainstream use.

Drivers who purchase EVs are eligible for tax credits and incentives for making the green choice. Some all-electric and plug-in hybrid vehicles purchased new are eligible for a federal income tax credit of up to $7,500. In North Carolina and many other states, qualified EVs may use HOV or carpool lanes, regardless of the number of occupants, allowing them to bypass high congestion traffic areas.

If you place in service a new plug-in electric vehicle (EV) or fuel cell vehicle (FCV) in 2023 or after, you may qualify for a clean vehicle tax credit. Find information on credits from the IRS for used clean vehicles, qualified commercial clean vehicles, and new plug-in EVs purchased before 2023. The IRS has also released a fact sheet with frequently asked questions related to new, previously owned and qualified commercial clean vehicle credits.

Visit the Database of State Incentives for Renewables & Efficiency (DSIRE) to learn more about federal, state and utility policies and incentives to assist with upfront costs of electric vehicles and electric vehicle supply equipment. Maintained and operated by the NCCETC, DSIRE is the most comprehensive source of information on clean energy related policies and incentives in the United States with summaries of more than 2,600 incentives and policies.

Visit the Database of State Incentives for Renewables & Efficiency (DSIRE) to learn more about federal, state and utility policies and incentives to assist with upfront costs of electric vehicles and electric vehicle supply equipment. Maintained and operated by the NCCETC, DSIRE is the most comprehensive source of information on clean energy related policies and incentives in the United States with summaries of more than 2,600 incentives and policies.

If you are considering making other energy improvements to your home, NCCETC recently published a new Word to the Wise resource to help you become a better educated consumer and navigate the financial incentives offered to you by electric utilities, localities, states, or the federal government. This edition of the Word to the Wise features “Your Guide to Home Energy Upgrades with the Inflation Reduction Act” and includes information about the many incentives expanded or made available via the IRA. To help as many interested individuals as possible, NCCETC has also produced a version en español: Unas Palabras para el Sabio – “Su Guía para Mejorar su Energía en la Casa con la Ley de Reducción de la Inflación.”